Art Stewart, MPM

Many of us who have toiled long and hard in the trenches of the global corporate responsibility (CR) movement now relish its maturity. Responsibility-oriented business practices are becoming embedded within standard operating procedure for key areas across an increasing array of organizations.

Nevertheless, with this new level of strategic influence comes the recognition that CR practices are morphing into previously uncharted territory. With a more integral operational role comes a redefining of what constitutes responsibility practice overall.  We are migrating from CR as a reactionary movement of compliant behavioral modification in such areas as transparency, reporting, policy and public positioning to one of strategic imperative at the core of management, governance, operations and human capital functionality.

We are migrating from CR as a reactionary movement of compliant behavioral modification in such areas as transparency, reporting, policy and public positioning to one of strategic imperative at the core of management, governance, operations and human capital functionality.

Welcome to the new role for CR in Strategic Value Creation (“SVC”). SVC is a wholly integrated, multi-disciplinary approach that operationalizes the once underestimated 'soft' drivers of valuation and marketplace value to improve top and bottom-line performance while better meeting the real needs of all stakeholders. By overlaying the principles of Strategic Value Creation with new consciousness thinking on leadership, organization culture, human capital enablement and consequential change, one may achieve a Strategic Value Advantage.

CR Takes Its Place in the Solution Set

The sheer scale of innovation in the global responsibility movement in recent years should take your breath away. From the GRI, CDP, Dodd-Frank and Sarbanes-Oxley to Conscious Leadership, Conscious Capitalism, Shared Value, and a new attentiveness to materiality with the SASB frameworks – global change-makers from every facet of society are building consensus for action with heightened expectations for real results. All of this is particularly evident in the Climate Change accord as well as the deliberations coming out of the World Economic Forum at Davos earlier this year. Whatever twists and turns await as the Trump Administration takes office, an historic plate shift is underway: The real choice for U.S. policy going forward will be to either lead in partnership with the rest of the world, or follow and risk falling fast and far behind.

Despite the many advances in policy, regulation, frameworks and best practices, public confidence in leaders and the exercise of institutional leadership that results in organizations doing the right thing – especially in a crisis – remains at historic lows.  There is persistent and pervasive distrust of both business and government as legitimate agents of real change devoid of self-interested agendas.

There is persistent and pervasive distrust of both business and government as legitimate agents of real change devoid of self-interested agendas.

The gap between the actual change taking place and the public’s knowledge, or recognition, of that progress is troublesome and can create an impediment to future achievements. Many stakeholders argue that we have reached a tipping point in which advances are threatened, or could be stalled, as a result of deep-seated systemic challenges which until now have not been deciding factors in CR’s evolution. There is no better an illustration of this than the ongoing Federal policy gridlock in Washington DC, the continuing challenge to the validity of climate science, and the Supreme Court’s decision against the EPA and its rules limiting toxic mercury emissions from oil and coal-fired power plants.

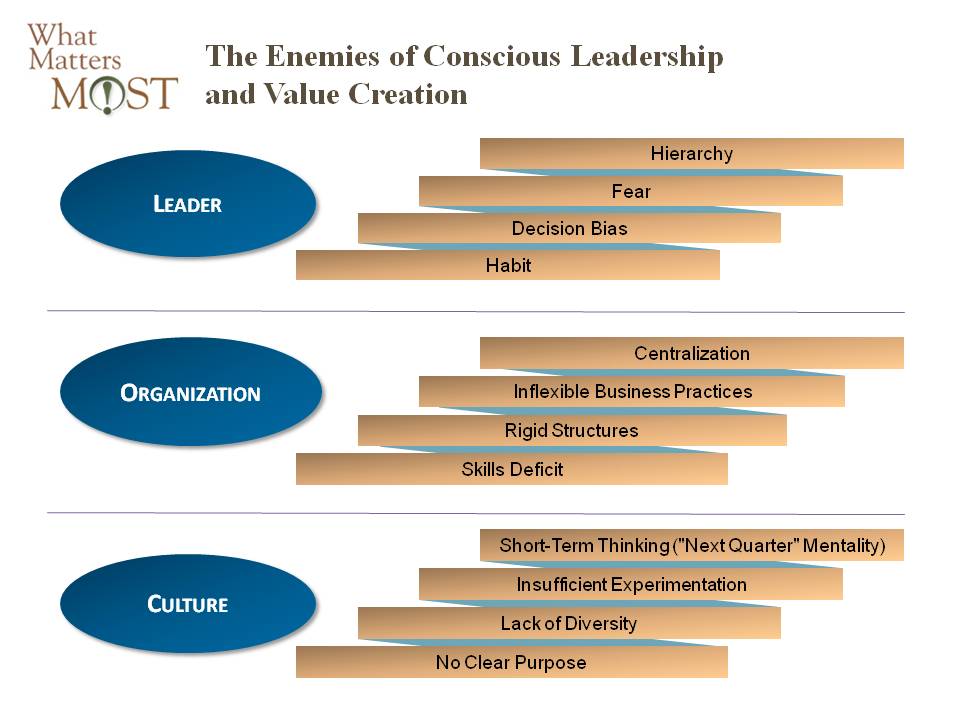

The terrain ahead is fraught with ingrained ways of thinking premised upon conviction and a perceived invincibility that accompanies precedent. Such convictions are perpetuated by deeply institutionalized systems and processes that depend upon a continuing industry context. That alone can make deconstructing or extracting them from an organization’s DNA difficult.

Disruption is the Friend of Change Agents

Ironically, the greatest hope for transformation stems from the shear breadth of disruption that organizations are now experiencing. As events escalate in frequency and scope, they can impact component or raw material access, production, distribution and integration; enable the most subtle of factors to create a ripple effect on business continuity; and restrict whatever decreasing direct control companies hold over their own destiny in these situations.

Many conscious CEOs will be the first to admit that corporate management teams need to run their businesses better. Executive and organizational leadership is at a crisis point. Traditional approaches to building highly-productive workforces and resilient businesses are no longer effective. The extent of employee disengagement on the job is at an historic high throughout all ranks. Generational differences between young and mature workers have revealed deep gaps that are posing challenges to existing leadership methods, management and governance models, human capital optimization and the improvement of corporate culture.

Employees who are underutilized are often also under-nourished. As a group, they are aggregating an under-performing entity within the enterprise. Shareholders and investors are assuming more risk to their investment, stemming from inferior leadership performance and its resulting outcomes. Customers are directly experiencing any leadership shortfalls most extensively from diminished value delivery.

The picture is not much different when you account for the macro context. Four years ago, a Harvard Business School survey of 10,000 alumni affirmed that the U.S. was facing a “deepening competitiveness problem” from “structural changes” that took root long before the great recession in 2008 – and that these changes threaten to undermine the long-term competitiveness of the nation. While respondents agreed that the American economy was strong, they also expressed concern that it was not keeping pace with other, or emerging, economies. The weaknesses identified include the tax code, political system, K-12 education, the legal framework, macroeconomic policies, regulations, infrastructure, and workforce skills.

Some 71% of those graduates surveyed said they expected U.S. competitiveness to decline in the next 3 years (by 2015), threatened by global risk factors, faltering growth, a slowing pace of innovation, more difficulty leading global trading, and our investment system. The perspective of this alumni community, however foretelling, is worth noting as we prepare for a new presidency elected on a platform for change involving these very concerns.

What We Anticipate: Trends to Watch

Here is a snapshot of some of the trends in responsible business practice that the SIP team anticipates affecting strategic value creation:

Organization Leaders

- While the evolution of the Corporate Responsibility Officer (CRO) has hit a wall, there is hope as the scope of what constitutes corporate risk and effective risk management morphs into a multi-disciplinary call to action; the future of the CRO coincides with a maturing relationship between the Board, the CEO, CPO (Chief Procurement Officer) and corporate counsel

- CFOs are having an epiphany as the real financial impacts of responsible business practices gain credibility, buoyed by a new emphasis on materiality

- The procurement function and its rank-and-file leadership are emerging as emboldened change agents in the evolution of supply chain strategy

The Organization

- We are at a tipping point in the battle between Old-Guard versus Next-Generation organization models; the path to new best practices will be shaped by the course of global economic policy and the extent of any U.S. resurgence in economic nationalism

- We now face sustainability reporting saturation and standards reinvention, driven in part by the onset of ‘radical transparency’ via Big Data

- ‘Radical transparency’ is exposing the reluctance of companies to share information that could be used to criticize their behavior – and that natural impulse opens them up to unfair characterization and suspicion

- As the supply chain becomes the new frontier in enterprise risk management, a new metric – the KRI or ‘Key Risk Indicator’ – is helping to better identify potential flash points in supply networks and procurement operations

- More companies are being asked to conduct due diligence in compliance with new laws and increasing regulation – particularly global issues involving corruption risks in human capital, such as human trafficking in supply chains

- Most organizations are now having to take on managing the nexus between climate change and ‘resources descent’

- We are deep into the ‘Millennial Revolution’ but it remains unclear the extent in which it brings real promise for a new age of responsibility, or it becomes a characteristically hollow threat of the rising generation

- A new social contract of human capital development is necessitating an overhaul in the approach to organization design

- A process of “de-firewalling” is collapsing traditional organizational fiefdoms and melding the disciplines of ethics and compliance, regulatory affairs, risk management and corporate counsel, procurement and the supply chain, governance practices, corporate responsibility, brand building and stakeholder engagement

The Larger Context

- Just when the tensions between Western and Eastern notions of individualism versus collectivism are subsiding, the U.S. presidential election result may further complicate the path to global consensus and assimilation around such critical issues as climate change

- Credible responses to concerns around wealth disparity and economic inequality will continue to be barometers of corporate integrity – to be measured by an ever wider range of stakeholders and public interest advocates

- There will be more calls for business to step up its leadership game and address what many see as a “failure of imagination” to find creative solutions to our most pressing global challenges

-AS-